Kenya’s Company Register Shock: 109 Firms Dissolved, 81 Set for Deregistration — A Data-Driven Analysis of Economic Implications and Reactions

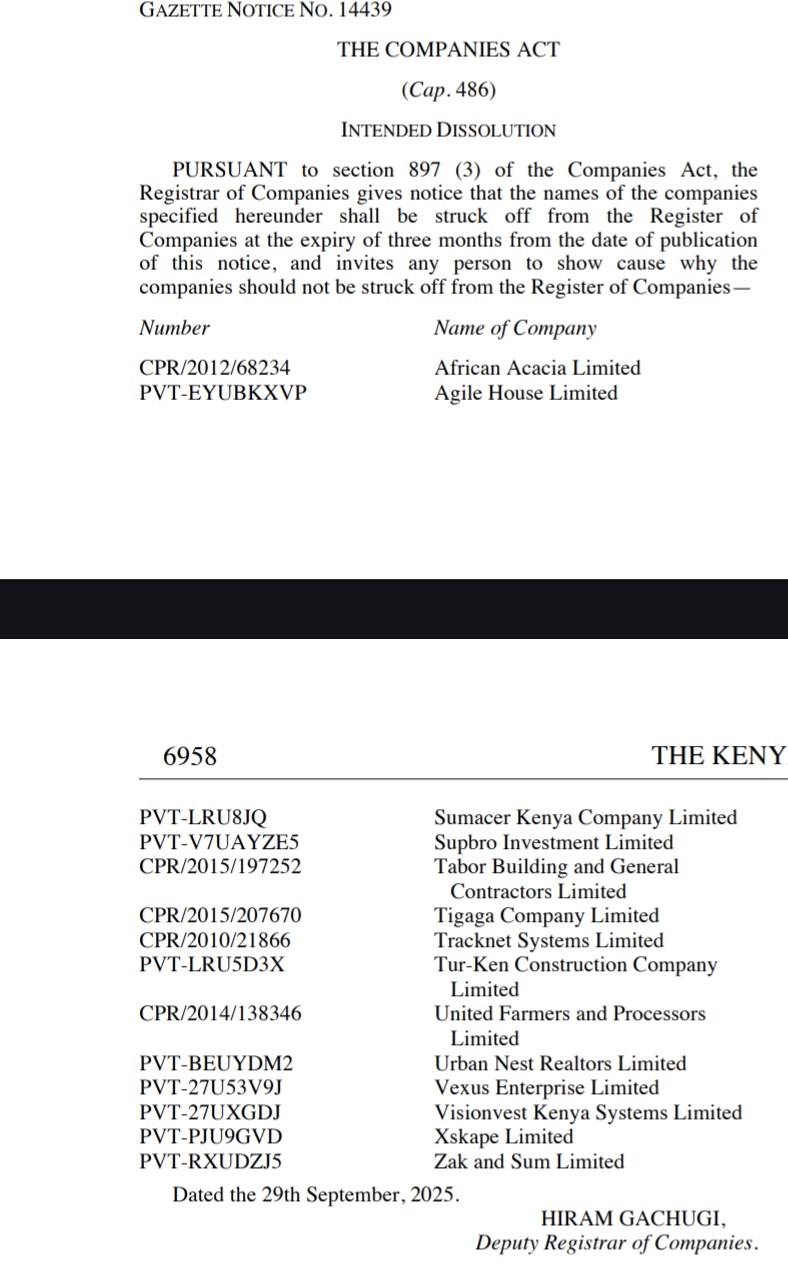

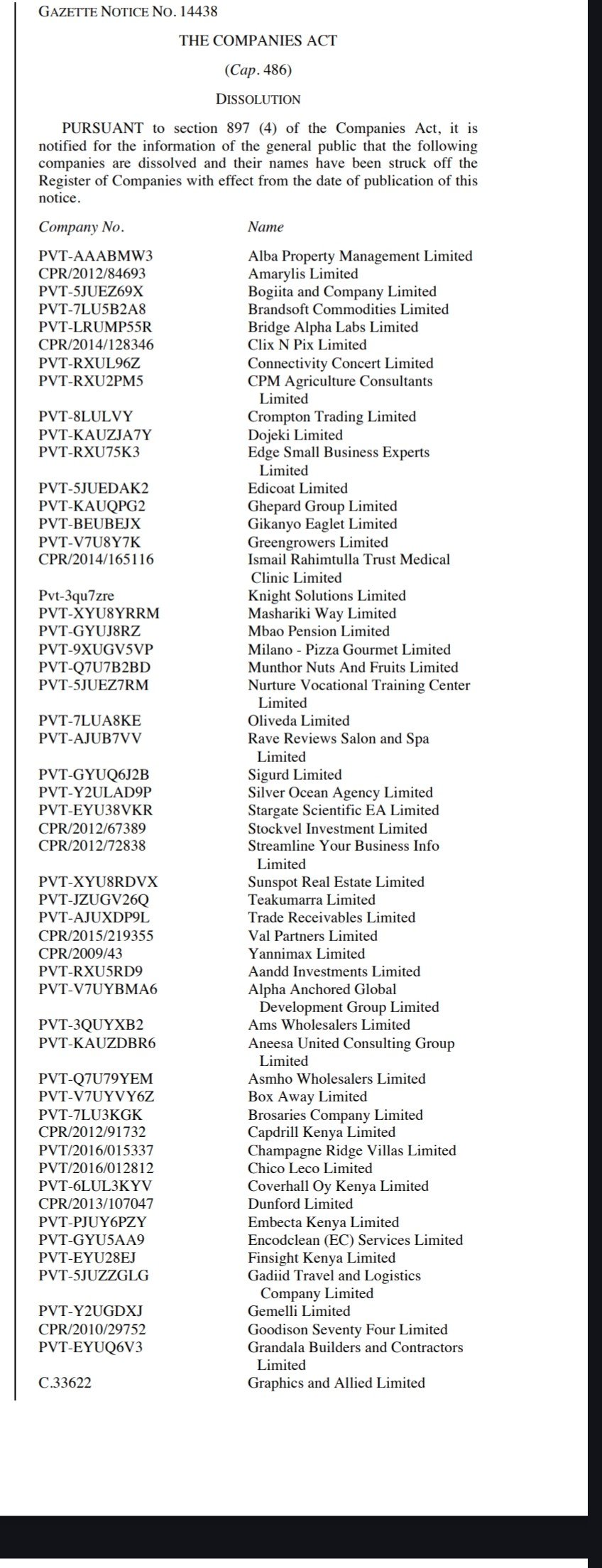

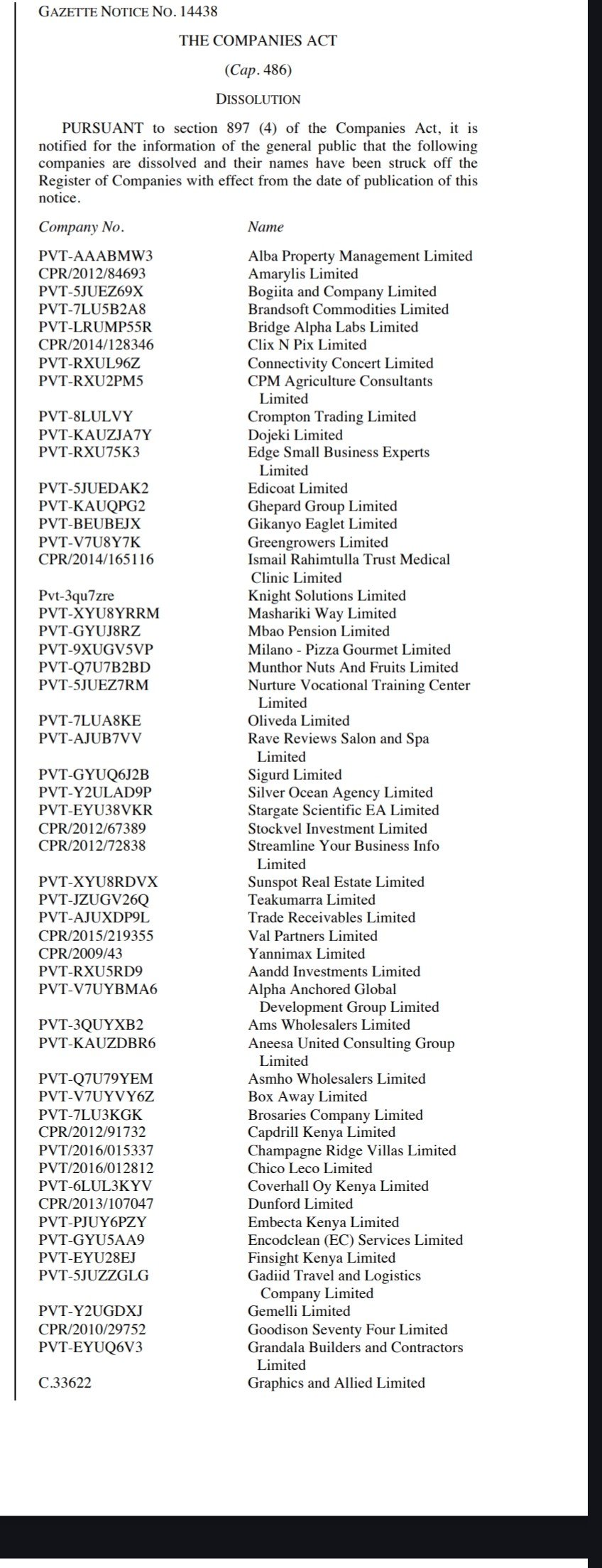

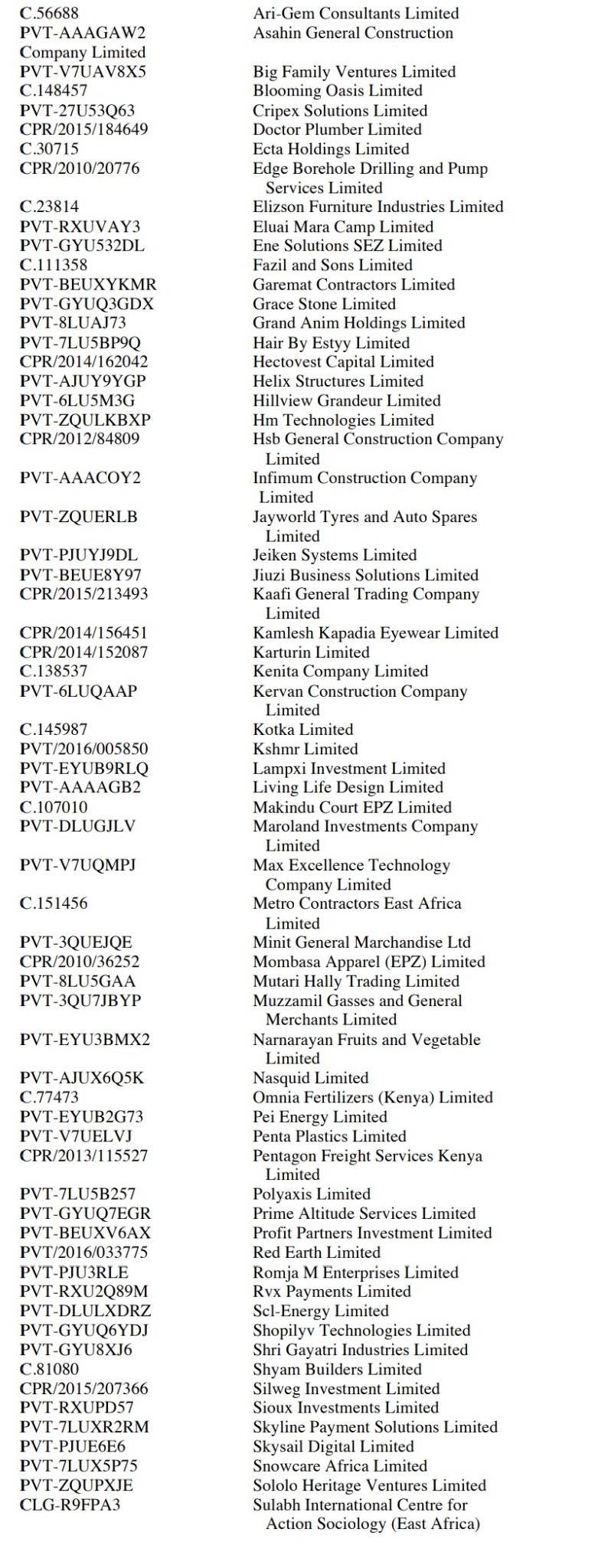

On October 9th, 2025, the Kenyan government announced via gazette notice the dissolution of 109 companies, with another 81 scheduled for deregistration within three months. This sweeping regulatory update has catalyzed conversations about Kenya’s business climate, government strategy, and the roots of widespread company closures.

Key Statistics & What Was Announced

-

109 companies officially dissolved as per the gazette notice.

-

81 more companies were targeted for deregistration within the quarter.

-

The lists include companies in various sectors, though explicit industry breakdowns are embedded within images, showing a diverse representation of firms.

-

Some companies have reportedly been restored following prior deregistration.

Patterns Observed in the Lists

Patterns Observed in the ListsFrom the images posted:

-

Many dissolved companies span from small private businesses to larger entities, hinting at both sectoral variety and the broad scope of government action.

-

Notable patterns include companies linked to short-term ventures, one-off tenders, and dormant entities, as reinforced in the replies and comments.

Companies that face deregistration:

This unveils several underlying causes:

-

Tax and Levy Increases: Multiple users cite surging tax rates (including VAT and excise duties per World Bank pressure), higher National Social Security Fund (NSSF) requirements, and a recently introduced housing levy.

-

Economic Hardship: Many companies failed due to declining consumer purchasing power amid a harsh economic environment.

-

Tax Compliance Crackdowns: The Kenya Revenue Authority (KRA) has enforced stricter compliance, resulting in the disappearance of up to 175,000 firms from its registry by June 2025, largely due to non-filing of tax returns.

-

Regulatory Reform and Market Shifts: The government aims to improve fiscal sustainability, including privatization steps like the planned Kenya Pipeline Company IPO, budgeted at 100 million shillings for advisory fees.

Socio-Economic Implications

-

Kenya’s business landscape is being reshaped by regulatory action and macroeconomic forces.

-

Small and medium enterprises, especially those unable to navigate increased compliance or weather economic downturns, are especially vulnerable.

-

The dissolution wave highlights the need for business owners to closely monitor regulatory updates and maintain robust compliance.

-

Discussions on social platforms reveal both concern and hope calls for policy reform, better economic stewardship, and support for entrepreneurial resilience.

Conclusion

The gazette notice dissolving 109 companies and threatening 81 more with deregistration marks a turning point for Kenyan enterprise regulation in 2025. As Kenya pursues deeper fiscal reforms, company owners and stakeholders must adapt, advocate, and remain informed; survival now hinges on both compliance and strategic adaptation.

What's Your Reaction?